|

From Accountingnet.ie Financial Reporting

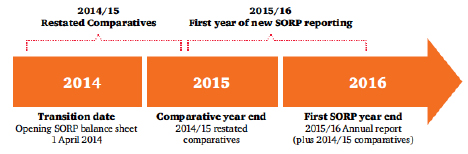

A new charity SORP has been published in the UK in order to provide guidance on the application of the FRS 102 accounting framework. The SORP also provides guidance to the charity sector on areas where FRS 102, the new UK and Ireland accounting standard, is silent or where guidance is considered necessary. FRS 102 is effective for accounting periods beginning on or after 1 January 2015. The implementation of FRS 102 and the new SORP presents a real challenge both in terms of practical understanding of the new requirements and what they willmean for individual institutions. Charities are not permitted to follow FRS 101. While in Ireland we await the regulations from the Minister for Justice and Equality in relation to the form and content of the financial statements and annual reports of charities, the SORP is considered at this point in time to be the best point of reference. The implementation timeline for an indicative March year end entity is summarised below:

To comply with this timeline all entities will need to be able to restate prior year comparatives so in the case of a March year-end the opening balance sheet position would be as at 1 April 2014. Therefore, work needs to begin now for all entities as data will need to be collected. Audit Committees need to understand the key areas of change so they will be able to properly discharge their responsibilities under the new SORP, as well as challenge progress with the conversion project which management will be undertaking. Management should start considering how best to plan for these changes and perform an impact assessment of the expected changes. The Charity should consider preparing their financial statements in compliance with the New Charity SORP, including the new disclosures and presentational requirements. In addition to presentational changes, there are some significant changes from the accounting framework. Key areas that will need to be considered include pensions, legacies and donated stock, revenue recognition, investment properties, intangible assets, financial and embedded derivatives and holiday pay accruals. http://download.pwc.com/ie/pubs/2015-pwc-ireland-charities-newsletter-january.pdf Teresa Harrington Price Waterhouse Coopers © Copyright 2005 by Accountingnet.ie |