|

From Accountingnet.ie Recession

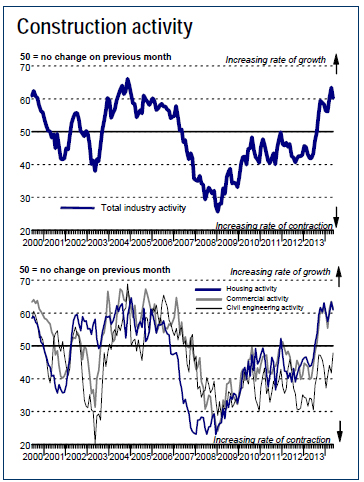

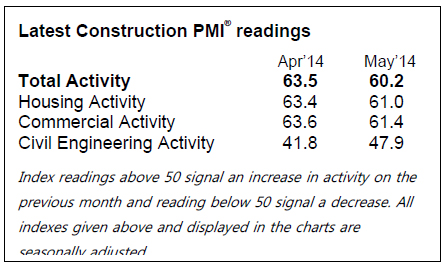

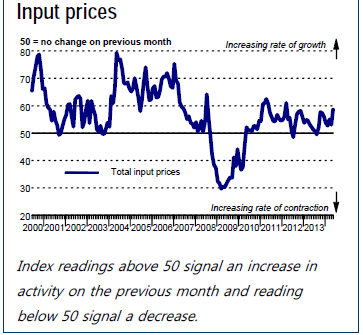

The recovery in the Irish construction sector continued in May. Although rates of expansion in activity, new orders and employment all eased from the highs seen in the previous month, they remained strong and companies were again optimistic regarding growth over the coming year. A marked acceleration in the rate of input cost inflation was recorded as suppliers took advantage of improved demand for inputs to raise their charges. The Ulster Bank Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index designed to track changes in total construction activity – posted 60.2 in May, down from the previous month’s reading of 63.5 but still pointing to a sharp increase in total construction activity. Activity has now risen in each of the past nine months, with the latest expansion linked to higher workloads and improving confidence. Commenting on the survey, Simon Barry, Chief Economist Republic of Ireland at Ulster Bank, noted that: “The latest Ulster Bank Construction PMI signals ongoing strong monthly growth of activity, with May’s headline reading only slightly below April’s near-record high. The recovery continued to be centred on housing and commercial activity, with both areas posting substantial rises again. However, there was some welcome news with regards to civil engineering activity, which decreased at the slowest pace since the end of 2007. “The rate of growth in new orders also remained sharp despite easing from the previous month. Companies reported success in securing contracts for work both in Ireland and abroad and were confident that these trends would continue over the coming year, leading to further growth of activity during the next 12 months. This optimism encouraged firms to take on extra staff and raise their purchasing activity, in both cases at marked rates. “Another notable aspect of the latest data was a sharp acceleration of cost inflation amid reports that suppliers have started to raise their charges in response to strengthening demand for inputs. Overall, the May data re-affirms the recent view of a sector on the mend.”

Sharp expansion in commercial activity

New order growth eases, but remains strong

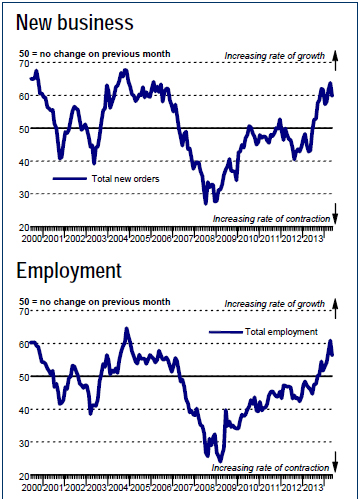

Rises in purchasing and employment Reports from panellists suggested that suppliers had responded to higher demand for inputs by raising their charges. This contributed to a solid increase in input prices, the sharpest since March 2012. There was evidence that suppliers had maintained a preference for low stock holdings in May, thereby leading to a further lengthening of delivery times in the sector. Companies remain strongly optimistic

Chief Economist Republic of Ireland Ulster Bank t: 01 6431553 m: 086 3410142 g: 01 6431688 e: simon.barry@ulsterbankcm.com w: www.ulsterbankcapitalmarkets.com 3rd Floor Dealing Room © Copyright 2005 by Accountingnet.ie |